how are rsus taxed at ipo

The current market value keeps changingI. You have compensation income subject to federal and employment tax Social Security and Medicare and any state and local tax.

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

But remember that there are two sets of taxes for RSUs.

. RSUs are really simple in the way they get taxed. As you continue to vest each month or quarter you will continue to. When they vest you have to pay taxes on them.

That amount is considered ordinary income. Your companys trading policy. This final vesting is marked by the transfer of shares.

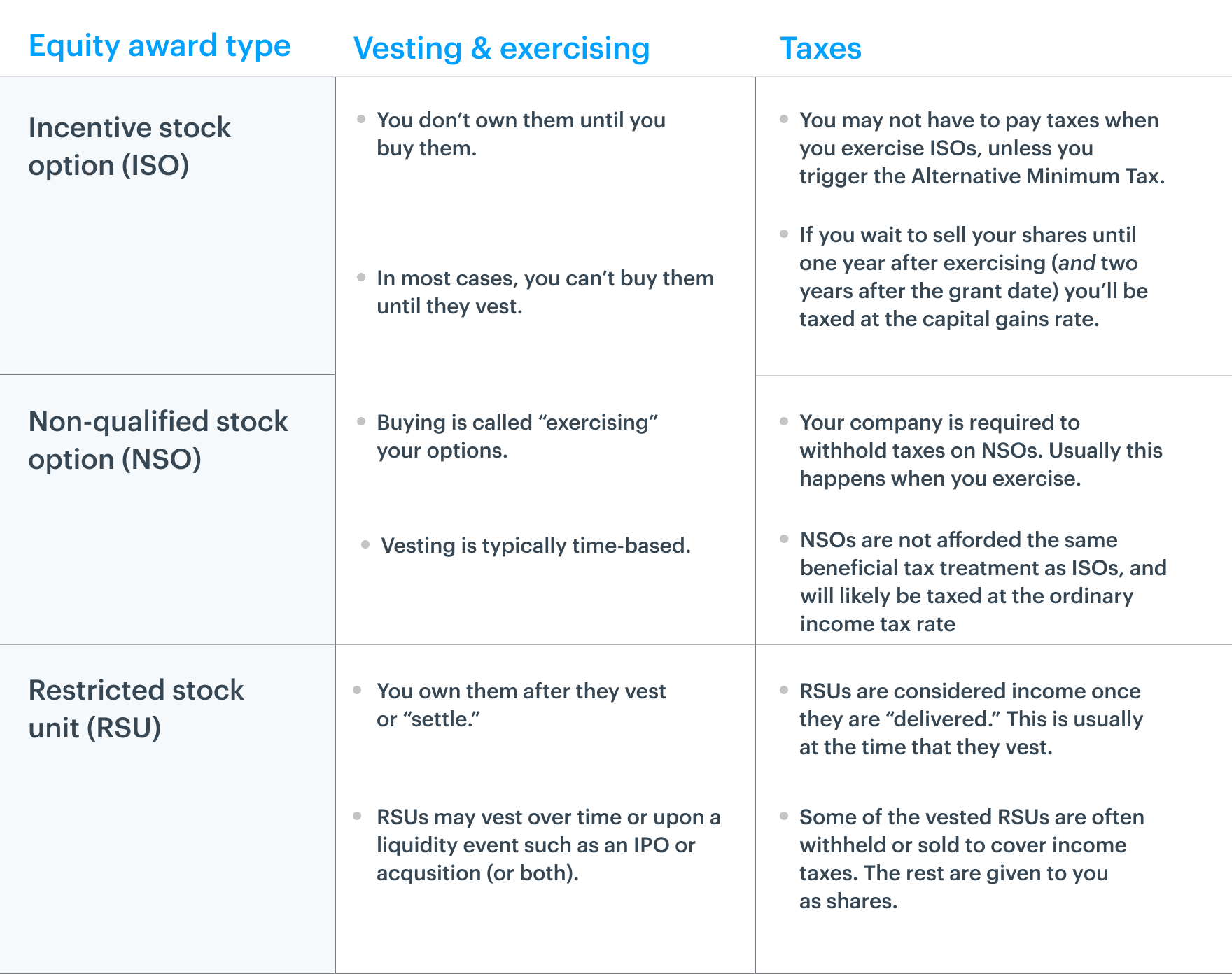

Vesting schedules for RSUs are usually time and event driven. RSUs and Capital Gains Taxes. Here are the different ways you can be taxed.

I was allocated some pre-ipo RSUs. I will be selling all of them and want to understand how are they taxed so that I can save the money for next years filing before investing the sum in ot. If your company grants you RSUs the total amount vested at the time of IPO is classified as supplemental income and is taxed at the regular income tax bracket rate.

If you then hold the vested shares for over one year before selling them then any additional gains would be then be taxed at the long-term capital gains rate. If you hold the stock for less than one year your gain will be considered short term. If your company is private youll need to wait for a liquidity event like an acquisition or IPO or if your company approves find a willing buyer.

Long-term capital gains are taxed at a rate of 0 15 or 20 depending on your taxable income and marital status. You wait until the RSUs vest. Yet all the RSUs are released fully on that day and you owe taxes.

In all states RSUs are taxed as regular income based on value at time of vesting. Long-term capital gains rates are likely the lowest tax on your company shares. You pay taxes on the value of the RSUs at vesting income taxes.

My grant price per RSU was 20. That income is subject to mandatory supplemental wage withholding. Hi Blind making some numbers up to stay anonymousI was given 100k worth RSUs vestable quarterly over 4 years.

How much youll be taxed. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non. The company went public and the lockdown period ends in May.

Short-term capital gains are typically taxed as ordinary income. You pay taxes again when you sell the shares resulting from the vested RSUs capital gains taxes. In publicly traded companies even a large tax obligation from vested RSUs poses little problem because the employee can sell some of their shares to pay the income tax.

When thinking about whether to sell your RSUs its a good idea to consider things like. An employee is taxed on the market value of vested RSU shares when the shares are delivered. RSUs are taxed as ordinary income at the time they become vested and liquid.

So if youre vesting shares over the years there are no taxes at each vesting but once the company goes IPO you get a waterfall of stocks that youll pay all the taxes on all at once. For pre-IPOs the RSUs will vest but its not considered income until the company goes public. How are pre IPO RSUs taxed.

Posted by 23 days ago. However you can either file an 83i to defer taxes or sacrifice a portion of the shares to cover taxes. So if you had 10000 RSUs youd actually receive only 7800.

RSU During a Typical IPO. How are RSUs of a pre-IPO company taxed. Posted this first on rIndiaInvestments but didnt get any response.

Youll be required to pay the ordinary income tax rate on your gains. When they vest the number of shares that are vesting are multiplied by the current stock price. I vested 2 years worth of RSUs before the company IPOed at 50.

Now companies do usually withhold the statutory 22 tax rate usually by withholding shares from your total RSU grant. How you think the stock will perform in. How are RSUs of a pre-IPO company taxed.

If your RSUs vest when your company is still private youll owe taxes but not be able to sell the shares for the money youll need to pay the taxes. RSUs and Capital Gains Taxes. Chances are youve got double-trigger RSU that you get based on the amount of time youve worked for the company when the IPO happens.

Those RSU shares are taxed as ordinary income and reported in the employees pay stub and on Form W-2. Short-term capital gains are taxed at regular income tax rates which are higher. The employee will be taxed at ordinary income rates for the value of the award they received upon vesting.

If you hold the stock for less than one year your gain will be considered short term. Once the underlying stock is sold the gains on the sale are also taxable at the time of the sale. If you sell the stock at a higher price than its fair value at the time of vesting youll have a capital gain If you hold the stock for less than one year your gain will be short term and youll owe ordinary income tax on it.

Youll be required to pay the ordinary income tax rate on your gains. It was IPO Day When lets review you are not allowed to sell your shares. A stock option is taxed at the time it is exercised.

If you sell your stock after your RSUs are converted to shares of the company youll be subject to capital gains tax as well. If you sell your stock after your RSUs are converted to shares of the company youll be subject to capital gains tax as well. In a way theres nothing different between private and public company RSUs.

Many public companies will require time-based vesting but could also include other performance-related requirements like reaching a target stock price. An IPO triggers taxes for RSUs even if you arent ready to sell the shares. And when that IPO happens the number of shares youve earned over time vest into your possession.

Your taxable income is the market value of the shares at vesting. Your company should withhold a portion of your RSUs at the time of IPO which will help cover a part of or all of your taxes owed. With RSUs you are taxed when the shares are delivered which is almost always at vesting.

How Is Restricted Stock Taxed. Clients often focus on capital gains taxes.

How Equity Holding Employees Can Prepare For An Ipo Carta

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Uber Lyft Pinterest And Zoom Sec Filings Reveal Trends In Private Company Stock Grant Design

Year End Planning For Employees With Post Ipo Losses Schmidt

Avoiding The 1 Million Tax Trap New Section 162 M Regulations Affect Use Of Rsus By Ipo Companies Compensia

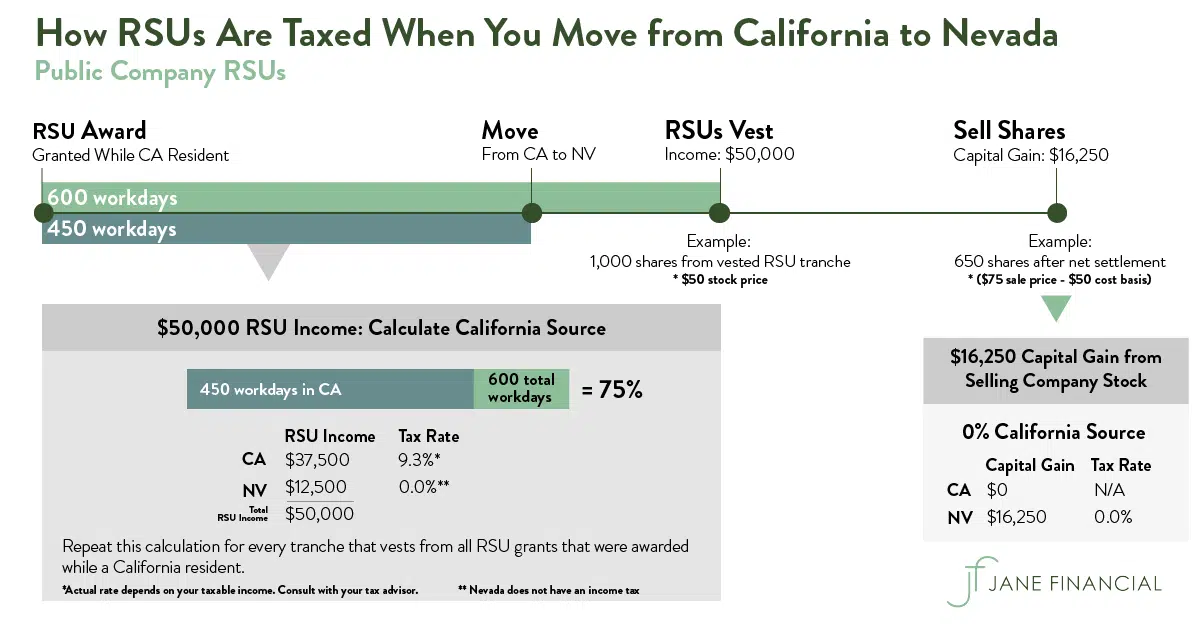

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Restricted Stock Units Jane Financial

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Restricted Stock Units Jane Financial

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Restricted Stock Units Jane Financial

Uber Lyft Pinterest And Zoom Sec Filings Reveal Trends In Private Company Stock Grant Design